Per 30. September 2022 nimmt PostFinance die roten und orangen Einzahlungsscheine (ES/ESR) vom Markt. Betroffen…

In diesem Beitrag: Abstract Part 1: Digitale Dokumente – Schluss mit den Papierbergen Part 2:…

In diesem Beitrag: Abstract Ergebnisse der Bitkom-Studie Erreichen der Klimaziele Ein Blick in die Zukunft…

In diesem Beitrag: Nutzen der Rechnungsautomatisierung Möglichkeiten der Rechnungsautomatisierung Diese Vorteile bringt die Rechnungsautomatisierung mit…

In diesem Beitrag Wofür steht Purchase-to-Pay Welche Ziele und Vorteile bietet Purchase-to-Pay Welchen Mehrwert bietet…

In diesem Beitrag Netzwerkpartner eBill Rechnungen stellen, pünktlich Geld erhalten eBill für Unternehmen Für welche…

In diesem Beitrag: ebInterface 6.0 vs. andere elektronische Rechnungsformate: Worin liegen die Unterschiede? Was sind…

In diesem Beitrag: Definition: Logistik einfach erklärt! Welche Ziele verfolgt die Logistik? Die unterschiedlichen Teilbereiche…

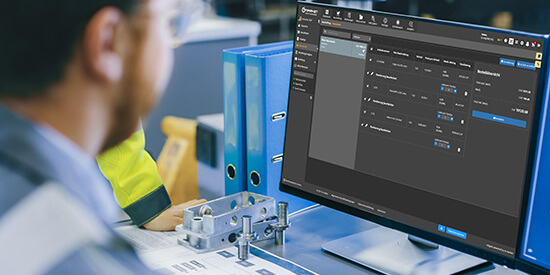

In diesem Beitrag Beschaffungsportal Wie funktioniert die elektronische Beschaffung Funktionen Individueller Bestellprozess Vorteile des Beschaffungsportals…

Damit diese Fragezeichen schon bald der Vergangenheit angehören, möchten wir uns in unserem heutigen Blogbeitrag…

Unter dem Begriff des elektronischen Datenaustausches, kurz auch EDI, versteht man wie die Bezeichnung bereits…

Das Kreditorenmanagement ist die Grundlage für eine schnelle und effiziente Bearbeitung der eingehenden Rechnungen.

Die Funktion des Contract Managements liegt in der Verwaltung und Optimierung der Vertragsbeziehungen von Unternehmen…

Mit der Einführung eines neuen ERP-System wagte sich die Käppeli Gruppe an die Digitalisierung der…

Die Schoch Vögtli AG ist ein leistungsfähiger Versandhandel für Schul- und Bürobedarf, EDV-Zubehör, Betriebsmittel, Kopierpapier,…

Das Wort Blockchain liegt in aller Munde: Kein Unternehmen, das nicht darüber spricht. Kein Investor,…

Ihr Geschäftspartner hat Sie angesprochen, wann Sie endlich auch eine EDI-Schnittstelle einrichten? Jetzt steht die…